HOME > 아카이브 > 미디어허브(영문)

The Korean Ministry of Culture, Sports and Tourism (headed by Minister Park Bo-gyun) conducted an investment briefing on July 24, focused on attracting investment from the UAE sovereign wealth fund for content industries, including games, dramas, and webtoons. The briefing was held in collaboration with the Korea Development Bank’s UAE Investment Cooperation Center.

This investment initiative follows up on the UAE sovereign wealth fund’s announced $30 billion investment in Korea, as declared at the Korea-United Arab Emirates summit in January 2023. It was selected as a priority area for investment cooperation in May, and was designed to support investment in the cultural sector.

As the Middle East market becomes increasingly attractive for Korean games, domestic game companies have been paying close attention.

Rapid Emergence of the Middle East Market

According to the Korea Creative Content Agency’s 2022 Second Half and Annual Content Industry Trend Analysis Report, the Middle East market is showing considerable interest in the Korean content field, particularly in the gaming industry, which has the largest export volume, accounting for about $5.31946 billion (67.4%). The game industry also made it to the government’s list of 30 promising export items selected in May.

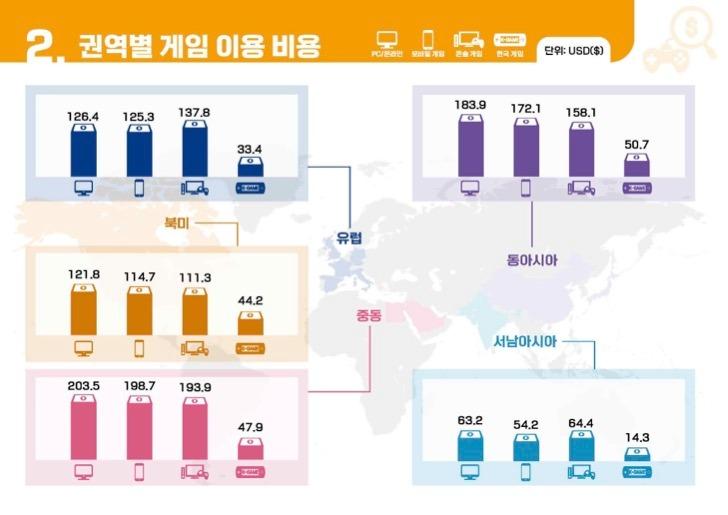

The game usage cost in the Middle East was comparatively high against other countries. As per the Korea Creative Content Agency’s 2022 Overseas Game User Survey, monthly average game usage costs ranked highest in Qatar ($266.52) for PC/online games and in mobile games, with Qatar ($256.75) outperforming China.

Growth Secret of the Gaming Industry: A Special Zone for Game Developers in Pangyo

Large gaming companies such as Nexon, NCsoft, NHN, Kakao Games, Neowiz, Smilegate, Webzen, and Wemade, along with startup game developers, account for about 40% of all domestic game companies located in Pangyo Techno Valley. Over the past decade, the government and Seongnam City have championed the growth of the gaming industry in Pangyo, establishing it as a national games hub.

In 2021, an area measuring 1,103,955㎡ surrounding the 1st and 2nd Pangyo and Kins Tower was designated as the “Pangyo Game Content Special Zone”. By 2025, the government and Gyeonggi-do plan to invest a total of 171.9 billion won in the creation of infrastructure for the content industry, development of the ecosystem, strengthening of corporate support programs, and the promotion of industrial vitality.

Seongnam City has further supported the gaming industry’s growth through deregulation in Pangyo. It has implemented priority examination of patent applications, outdoor advertisement laws, and special cases for road occupation regulations to effectively boost public relations and related marketing events..

Moreover, Seongnam City is looking for opportunities to work with related countries for Pangyo-based companies to enter the Middle East market. In March 2023, it reached an agreement with the Dubai Multi Commodities Center (DMCC), a hub for industry and trade in the United Arab Emirates, to collaborate with companies and startups in the Game Content Special Zone and to explore support plans for the gaming industry to enter the DMCC.

Localization: Key to Global Competitiveness of the Korean Gaming Industry

To further strengthen its position in the global gaming market, the Korea Creative Content Agency suggests in its paper “Global Game Policy and Legislative Research” that Korean games need country-specific strategies for localization, such as country-specific laws and personal information protection laws, to maintain global competitiveness.

For instance, Saudi Arabia offers a five-year grace period for collecting and processing personal information through membership registration and payment, while Egypt requires the designation of a relevant domestic agent. Besides, the age of majority is 18 years old in Saudi Arabia and 21 years old in Egypt and the United Arab Emirates.

By adopting strategic localization per country, Korean games are expected to fortify their competitiveness in the global gaming market, reconfirming their status as the original “Korean Wave” content and continuing their box office success.